About Ventas

Delivering Outsized Value

Ventas, Inc. (NYSE: VTR) is a leading S&P 500 real estate investment trust focused on delivering strong, sustainable shareholder returns by enabling exceptional environments that benefit a large and growing aging population. The Company’s growth is fueled by its senior housing communities, which provide valuable services to residents and enable them to thrive in supported environments. Ventas leverages its unmatched operational expertise, data-driven insights from its Ventas Operational InsightsTM platform, extensive relationships and strong financial position to achieve its goal of delivering outsized performance across approximately 1,400 properties. The Ventas portfolio is composed of senior housing communities, outpatient medical buildings, research centers and healthcare facilities in North America and the United Kingdom. The Company benefits from a seasoned team of talented professionals who share a commitment to excellence, integrity and a common purpose of helping people live longer, healthier, happier lives.

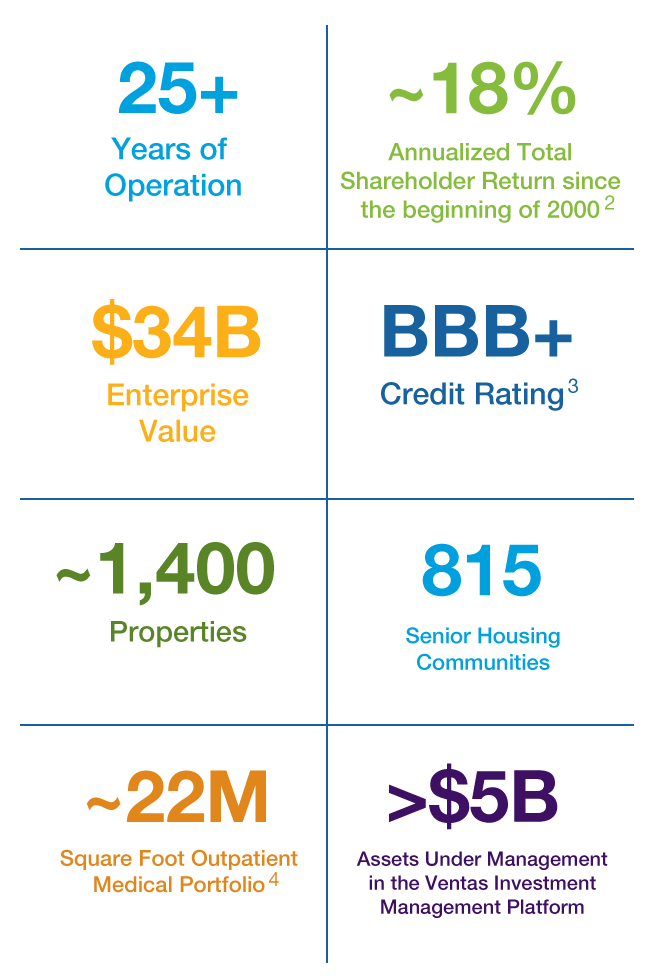

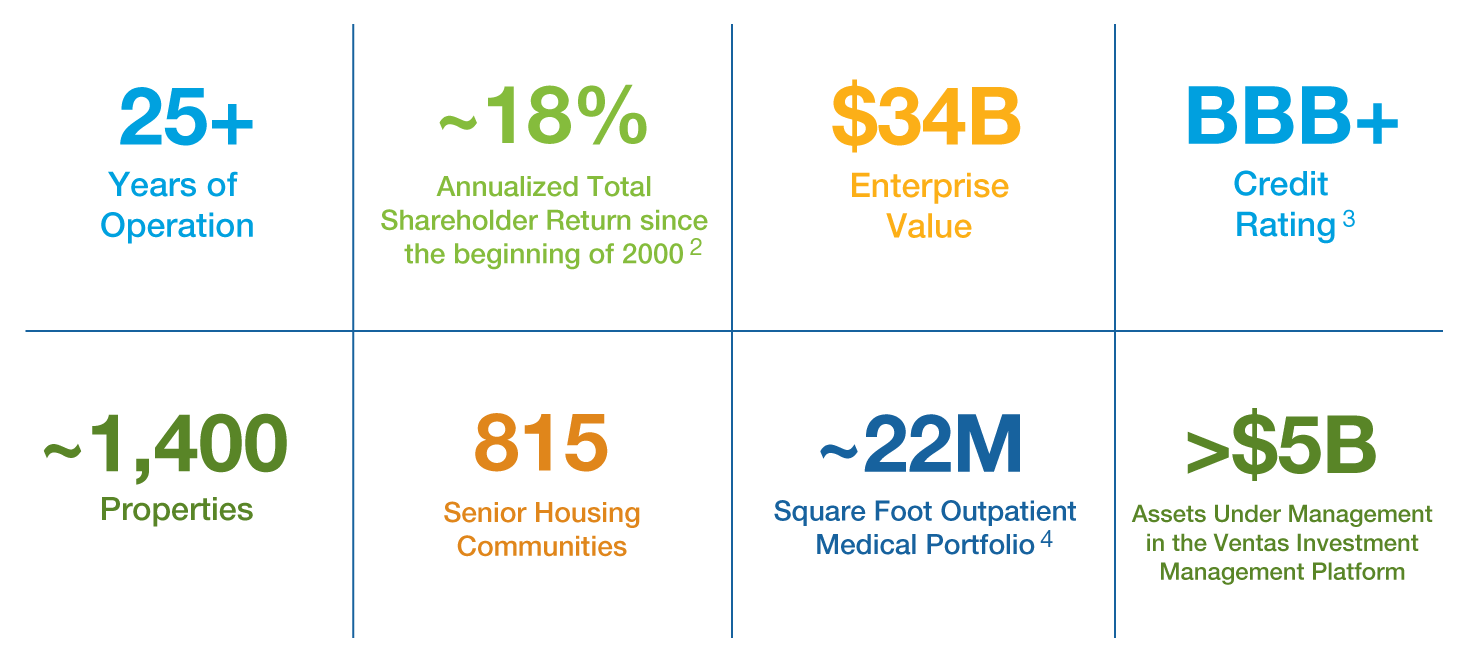

A Snapshot of Success1

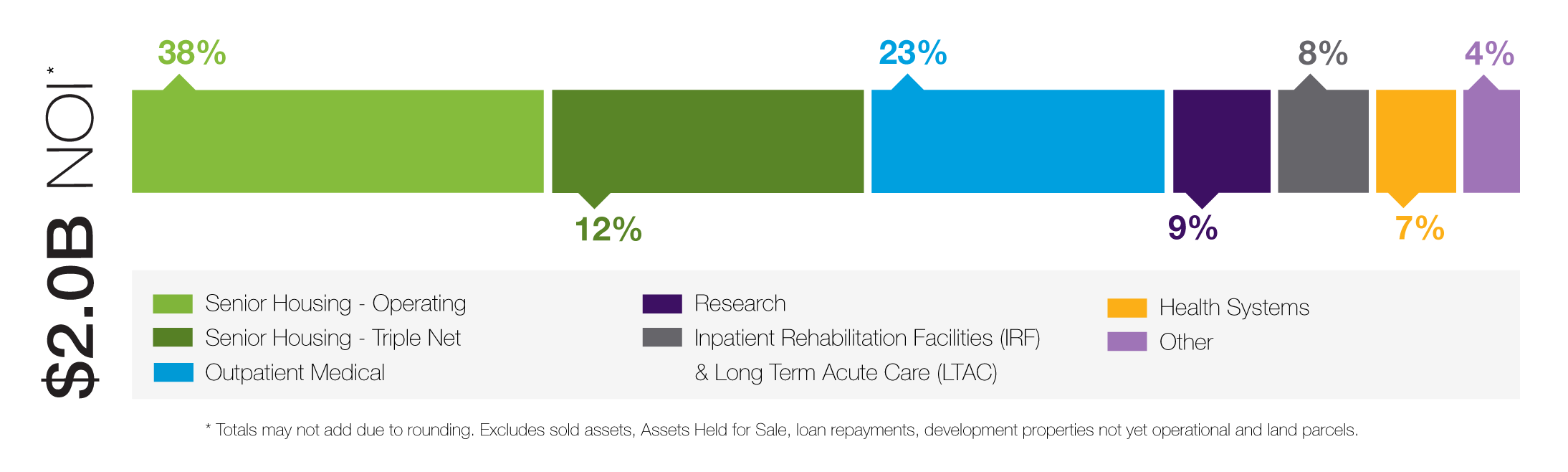

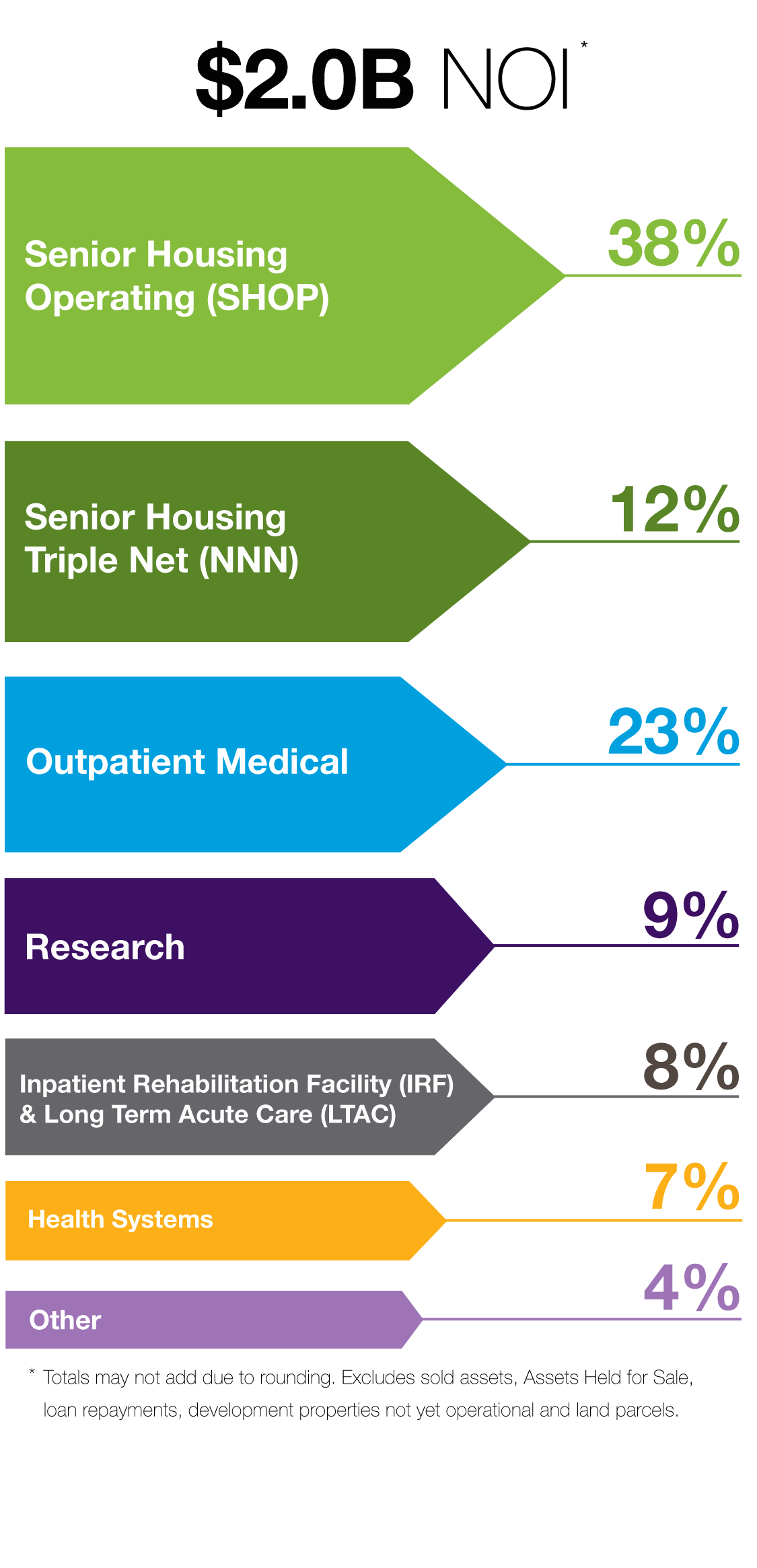

High-Quality Assets Unified in Serving the Large and Growing Aging Population

Our portfolio of high-quality assets is unified in serving the large and growing aging population and well positioned to capture compelling demographic demand. Our portfolio is curated across geographies, asset types, business models and strategic partnerships to enhance the reliability of our cash flows and mitigate risk.

Ventas Investment Management

Ventas Investment Management (VIM) consolidates our extensive third-party capital ventures under a single umbrella. Within the $16 trillion commercial real estate industry, ~20 percent is owned by public entities like Ventas, while the remaining ~80 percent is in the hands of private investors.

VIM enables Ventas to access this expansive market opportunity by attracting global private capital to our demographically driven asset classes. Private owners of real estate seek to invest alongside Ventas directly in life science, senior housing and other healthcare real estate to obtain the benefit of our experience, relationships and industry knowledge.

With approximately $5B+1 in assets under management, the VIM platform includes the Ventas Life Science & Healthcare Real Estate Fund, our life science development joint venture with GIC and our senior housing development State Pension Fund joint venture. VIM enables Ventas to expand its footprint, diversify its capital sources, augment its investment capacity, accelerate its development and acquisition pipeline and generate additional recurring revenue and profit opportunities, all by leveraging its team and infrastructure.

Total Shareholder Return

Total Shareholder Return

since the beginning of 20002

- Information as of December 31, 2023.

- Factset, for the period beginning January 1, 2000 and ending December 31, 2023.

- BBB+ (stable) rating from Standard & Poor’s; Baa1 (stable) rating from Moody’s. A security rating is not a recommendation to buy, sell or hold securities and may be subject to revision or withdrawal at any time.

- Represents consolidated and unconsolidated properties and investments and in process developments underway.